2023/11/15

International Conference on Corporate Finance: Corporate Purpose and Sustainability ①

On August 4, the 6th International Conference, co-hosted by the Darla Moore School of Business at the University of South Carolina and Hitotsubashi University, was held at Hitotsubashi's Sano Shoin Hall with the support of the Mizuho Securities Endowed Course. The theme of this year's conference was Corporate Purpose and Sustainability and researchers from the U.S., Switzerland, Canada, Korea, China, and Germany participated in lively discussions.

In each session, after presentation of the research findings, a pre-assigned commentator ("discussant") gave his or her opinion on the research and was joined by other participants in a question-and-answer session. The theme of this year's symposium has been the subject of growing debate worldwide in recent years, and series of ambitious studies were presented that may have implications for corporate initiatives, investment behavior, and policy.

(Honorifics omitted)

【Session 1】"Environment"

Chairperson: Zacharias Sautner (University of Zurich and the Swiss Finance Institute)

| How environmental policy and product market competition affect green innovation? | |

| Presenter : | Lilian Ng (York University) |

| Discussant : | Yongtae Kim (Santa Clara University) |

| Institutional dual ownership and voluntary greenhouse gas emission disclosure | |

| Presenter : | Wolfgang Drobetz (Hamburg University) |

| Discussant : | Yukihiro Yasuda (School of Business Administration, Hitotsubashi University) |

Lilian Ng's study reveals the relationship between environmental regulations and corporate green innovation. It shows that as competition among companies becomes more important and environmental regulations become more stringent, more competitive companies will differentiate themselves through their environmental efforts, thereby increasing their market share and, in turn, their corporate value. Yongtae Kim expressed great interest in the possible impact of the level of competition on the relationship between environmental regulations and corporate green innovation.

Wolfgang Drobetz reported on a study that found the presence of a "dual holder", who holds both equity and debt claims, encourages companies to voluntarily disclose information on their greenhouse gas (GHG) emissions. Yukihiro Yasuda expressed his hope for further development of the research from the viewpoint of whether the degree of influence differs depending on the size of the dual holder's presence in the company.

【Session 2】"Boards"

Chairperson: Yongtae Kim (Santa Clara University)

| Board ancestral diversity and voluntary greenhouse gas emission disclosure | |

| Presenter : | Sadok El Ghoul (University of Alberta) |

| Discussant : | Iichiro Uesugi (Institute of Economic Research, Hitotsubashi University) |

| Empowering women by index membership: Evidence from a unique experiment from Japan | |

| Presenter : | Yusuke Tsujimoto (University of Alberta) |

| Discussant : | Jungwon Suh (Sungkyunkwan University) |

Sadok El Ghoul reported on his research that examined the ancestral origins of corporate directors and found a relationship between their diversity and voluntary disclosure of GHG emissions. He concludes that board diversity has a governance effect on corporate environmental efforts. Iichiro Uesugi commented that since board diversity and voluntary disclosure of GHG emissions received increased attention from society at the same time, it is not a correlation between the two, but rather that the strengthening of these efforts by companies may simply have occurred at the same time, and he expressed his hope for further verification of this relationship.

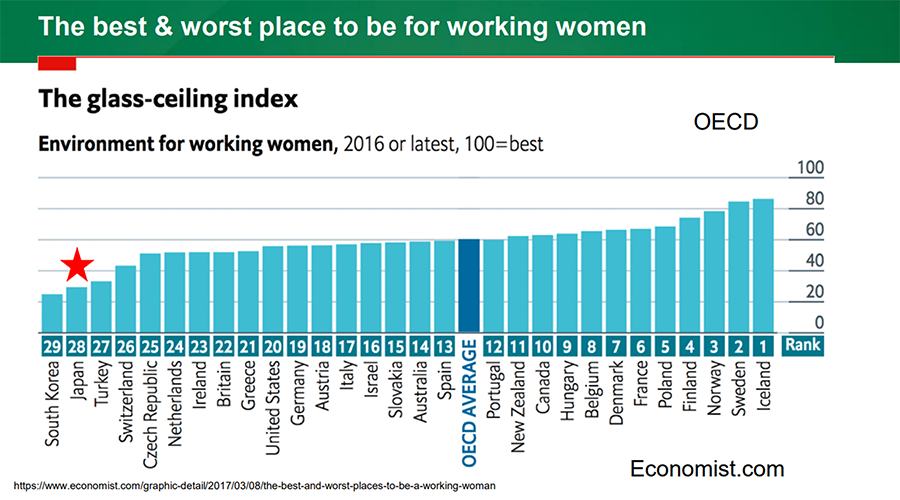

Yusuke Tsujimoto reported that after the GPIF (Pension Fund Management Independent Administrative Institution), which has enormous influence on the financial market, adopted the MSCI Japan Equity Women's Index (WIN) in 2017, the promotion of women in Japanese companies has progressed, especially in companies that are close to being selected as a WIN constituent stock or not. He also clarified that such indexation could have an impact on a company's social initiatives. In response, Jungwon Suh commented that the Act on Promotion of Women's Active Engagement in Professional Life, which came into effect in 2016, also has a significant impact on corporate actions related to women's advancement.