2023/11/15

International Conference on Corporate Finance: Corporate Purpose and Sustainability ②

On August 4, the 6th International Conference, co-hosted by the Darla Moore School of Business at the University of South Carolina and Hitotsubashi University, was held at Hitotsubashi's Sano Shoin Hall with the support of the Mizuho Securities Endowed Course.

International Conference on Corporate Finance: Corporate Purpose and Sustainability ①

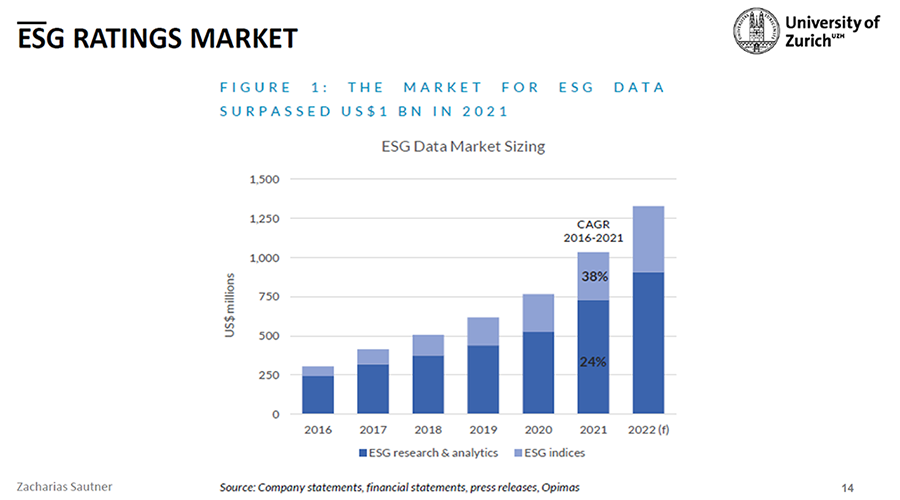

【Keynote Speech】"ESG ratings: What we do and do not know"

Zacharias Sautner (University of Zurich and the Swiss Finance Institute)

Zacharias Sautner noted that as ESG (Environmental, Social, and Governance) investment expands worldwide, the importance of third-party rating providers for corporate ESG initiatives is increasing. In particular, there are cases in which the rating methodology used by rating providers has become a "black box," and the ratings of the same company can differ greatly depending on the rating providers. In addition, there are cases where the rating methodology is changed abruptly or the change is not widely announced, which has a significant impact on investors who have formulated their investment strategies based on the rating. In light of this situation, ESMA (European Securities and Markets Authority) is moving to make ESG ratings an authorized rating system, which will require transparency in the rating methodology, disclosure of policies regarding information to be collected, and avoidance of conflicts of interest with companies to be rated. The move will require transparency in evaluation methods, disclosure of policies regarding updating data and revising historical data, and avoidance of conflicts of interest with the companies being rated. In addition to these institutional developments, it is important for investors to increase their own sensitivity to the ratings through a variety of publicly available information and dialogue with the target companies.

【Session 3】"Loans"

Chairperson: Lilian Ng (York University)

| Environmental penalty and cost of debt: Evidence from Chinese firms | |

| Presenter : | Daxuan Zhao (Renmin University of China) |

| Discussant : | Konari Uchida (Kyushu University) |

| An empirical analysis of green loan usage: Evidence from a government-affiliated loan scheme in Japan | |

| Presenter : | Hirofumi Uchida (Kobe University) |

| Discussant : | Kenichi Yoshida (Kyushu University) |

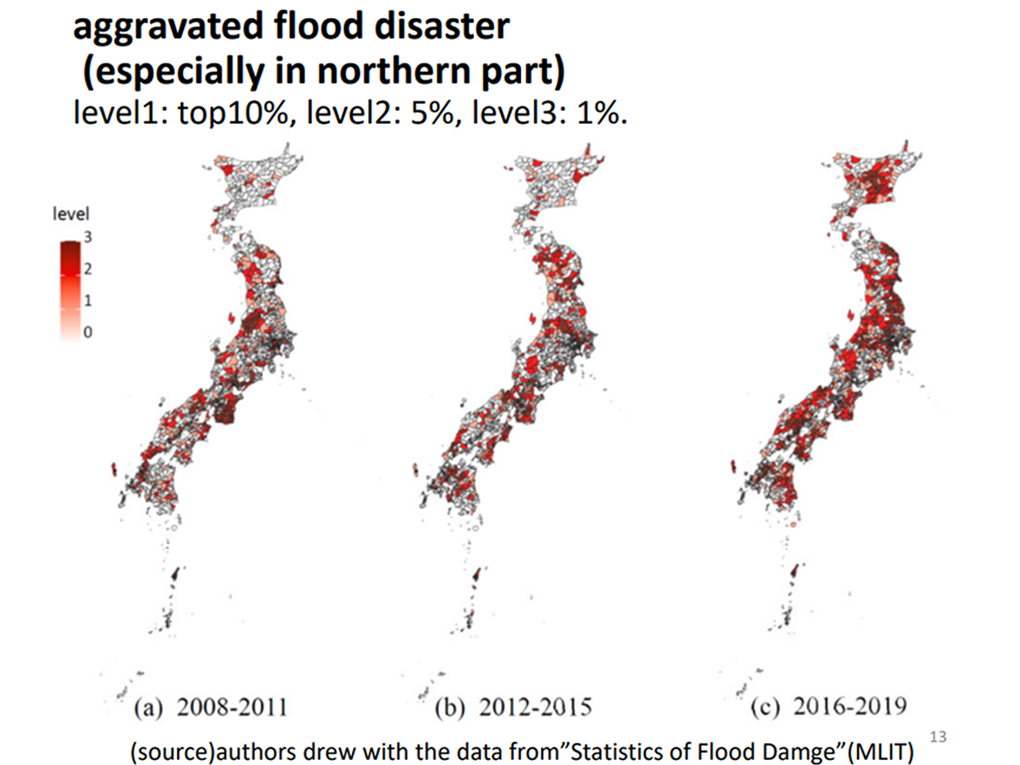

| Floods and loan reallocation: New evidence | |

| Presenter : | Yoshiaki Ogura (Waseda University) |

| Discussant : | Ming-Ming Wen (School of Business Administration, Hitotsubashi University) |

Daxuan Zhao reported on his research analyzing the correlation between environmental penalties and the issuance of credits by Chinese companies, finding that the public announcement of penalties affects the cost of credits, and also negatively impacts government subsidies and tax benefits. In response, Konari Uchida suggested that the impact of environmental penalties could be analyzed from a more multifaceted perspective, rather than just from the cost perspective of credits, subsidies, and taxation.

Hiroshi Uchida analyzed users of Japan Finance Corporation's Green Loan1and found that Green Loan users have strong business performance and high credit ratings. In response, Kenichi Yoshida expressed his hope that exploring why companies use green loans and what motivates them may provide meaningful insights into the design of green loan programs.

Next, Yoshiaki Ogura reported on his research on the relationship between flood damage, which has been increasing in recent years, and bank loans, and found that while SMEs in the affected areas increased their bank loans, those that suffered direct damage to their facilities due to the flooding reduced their bank loans and relied on trade credit.2 In response, Ming-Ming Wen suggested that it would be good to have an analysis from the perspective of banks' lending strategies.

1 Green Loans are used by corporations and local governments to finance domestic and international green projects and are specifically defined as loans where (1) the use of the funds raised is limited to green projects, (2) the funds raised are securely tracked and managed, and (3) transparency is ensured through post-financing reporting (Ministry of the Environment).

2 The act of deferring the settlement of claims and obligations arising from sales, services, and other transactions between companies for a certain period of time. Also referred to as commercial credit, this is the provision of credit in the form of a note receivable or accounts receivable from the company selling a product or other item to the company making the purchase.

【Session 4】"ESG"

Chairperson: Omrane Guedhami (University of South Carolina)

| Does the difference in awareness between asset owners and asset managers have an impact on firms' ESG activities? | |

| Presenter : | Yoko Shirasu (Aoyama Gakuin University) |

| Discussant : | Chun Lu (School of Business Administration, Hitotsubashi University) |

| Environmental challenge pressure and ESG disclosure: Evidence from carbon neutral declaration by Japanese Government | |

| Presenter : | Zhixiong Chen (KDDI Research, Inc. / School of Business Administration, Hitotsubashi University) |

| Discussant : | Xiaolin Zhang (Nankai University) |

| Floods and loan reallocation: New evidence | |

| Presenter : | Xinming Li (Nankai University) |

| Discussant : | Hiromichi Iwaki (Kanagawa University) |

To analyze the influence of asset owners and managers on ESG efforts, Yoko Shirasu tracked the responsible investment attitudes and actual actions of the GPIF, the world's largest asset owner, and its asset managers, and found that asset owners have more influence over asset managers. In this regard, Chun Lu expressed her interest in how asset owners exercise their influence and promote ESG initiatives, while asset managers have influence over issuers through the selection of investment stocks.

Next, Zhixiong Chen revealed that preferential policies for environmental initiatives can induce greenwashing disclosure, especially in financially distressed companies. In response, Xiaolin Zhang suggested that while there have been studies on greenwashing under environmental penalties and stricter regulations, the fact that such a phenomenon can also be observed under preferential policies offers a new perspective, and he expressed hope that analysis other than financial elements could be used to clarify the motivation behind this phenomenon.

Xinming Li reported on a study that looked at global supply chains in terms of whether their environmental efforts are influenced by the country characteristics of their customers. He showed that customers in countries with strong individualism tend to rate their suppliers' environmental performance lower, while customers in countries that emphasize uncertainty avoidance tend to rate it higher. In response, Hiromichi Iwaki expressed hope that it would be more meaningful if there were suggestions on how to promote environmental initiatives to customers with strong cultures of individualism under certain conditions.

Professor Omrane Guedhami, Darla Moore School of Business, University of South Carolina

This conference creates a forum of discussion and learning among distinguished scholars on a highly relevant and timely topic, namely corporate purpose and sustainability. The conference was an opportunity to showcase 10 high-quality papers and insightful discussions on a wide range of issues, including the roles of boards, institutional investors, and cultures. Building on the success of previous editions, this year conference was very productive and well-organized, thanks to the incredible efforts of the faculty and staff at Hitotsubashi University. I am confident that this conference will continue to strengthen ties between Hitotsubashi University and the Moore School of Business.